April is Financial Literacy Month

April 16, 2013

Every year the month of April is designated Financial Literacy Month on a state and national level. It’s a month committed to raising awareness of the importance of learning the basics of managing your individual finances. At Carrington College and Carrington College California, our Student Finance Advisors are always on hand to help guide you step-by-step through the financial aid process*, but these tips can help you learn to manage your broader finances.

- Examine your financial attitude – Do you take your finances seriously, or do you get by on a wing and a prayer each month? The first step to financial literacy is understanding the value of a dollar, and the importance of paying your bills and running a balanced budget.

- Have you set a weekly or a monthly budget? – Map out your expenses and your income, and try to balance the two. Cut your cloth accordingly. Setting a budget and sticking to it can be hard, but it’s the most effective way to control your finances.

- ‘Needs’ first, then ‘wants’ – Your budget should meet your ‘needs’ first (such as food, housing, gas to get you to work) before you start to think about the ‘wants’ (movie tickets, vacations, new clothes etc.) Allocate your income to the expenses that matter most to you. Your expenses should be less than or equal to your total income. If your income doesn’t cover your expenses, adjust your budget by deciding what expenses you can cut.

- Check your credit report – Your credit report will be looked at when you apply for a car loan, a home loan, a cell phone, utilities, a lease on an apartment, maybe even when you apply for a job. You have the right to a free credit report every year from each of the three major credit bureaus: Equifax, Experian and TransUnion. Visit www.annualcreditreport.com to get yours.

- Get credit errors corrected – If you find an error on your credit reports you can fill out an online form provided by the credit-reporting agency to dispute the item. The websites for the three major credit bureaus are www.equifax.com, www.experian.com, and www.transunion.com.

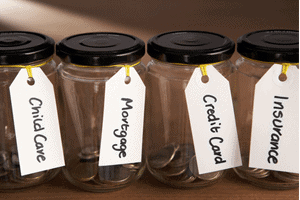

- Set your financial priorities – Goal setting is as important in finance as it is in any other aspect of your life. Getting your priorities in order will help you manage your money. Paying off an unsecured or secured debt might be top of your list, perhaps saving for a down payment on a home. Prioritize your needs above your wants.

- Pay down your debt – Being in debt can cost you money because, depending on the debt source, you may well be paying interest on the money you owe. People tend to use one of two ways to tackle debt. The first is to focus on paying down the debt with the smallest balance first. After that debt is cleared, they move on to the account with the next smallest balance…and repeat. Many people find this method rewarding because they can see progress. The second approach is to focus on paying off the debt with the highest interest rate first. This can save the most in interest charges over time. Don’t forget though that you have to make required payments to all debts; don’t ignore one at the cost of another.

- Start building a good financial reputation – Learn how to use credit cards responsibly, open a checking or savings account at your local bank, and don’t get overdrawn. If you have a paycheck, have it directly deposited into your account. Pay your bills on time each month, and try to save as much as you can every month. Even a small amount can make a big difference if you keep it up.

*Financial Aid available for those who qualify. It is the student’s responsibility to complete and submit all forms and/or applications required for all federal, state, and institutional sources.