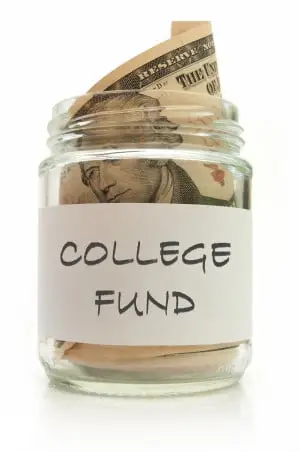

The 2016-2017 school year will be here before you know it. Here are five things you need to know about filling out your FAFSA®. We get that figuring out how to pay for college probably isn’t one of your favorite things to do, but you have to do it. We’re here to let you know why your FAFSA is so important and help you get it finished in no time!

FAFSA® stands for Free Application for Federal Student Aid. Filling out your FAFSA® is the first step in getting financial aid[1]. It can be overwhelming, but you need to buckle down and get it done if you’re looking for help paying for school. Lucky for Carrington College students, the Student Finance Department is here to help. “The sooner you renew your FAFSA®, the sooner the student finance office can review your processed application to determine if any additional documents or information is needed. That gives you extra time to resolve any issues. If you wait until the last minute it could delay your aid or your ability to register for future classes,” said Carrington College Student Finance Regional Director Stacey Valentine. If you’re thinking, “Wait, I filled this out last year!” you might need to do it again. Your 2015-2016 FAFSA® is only good until the end of June. If you’re looking for federal funding for 2016-2017 you have to fill it out again for this year. Here are five things you should know about FAFSA®.

It’s Free to Apply!

You really have nothing to lose if you try. Filling out the FAFSA® might take time, but it won’t cost you anything. Plus, why wouldn’t you want to spend a little time doing something that could help you?

You’ll need your 2015 income tax info and your FSA ID to complete the 2016-2017 FAFSA®. If you don’t remember your id you can go to fsaid.ed.gov and choose Edit My FSA ID.

Eligibility Requirements

Good news…as long as you meet the general eligibility requirements you’ll likely qualify for some type of assistance! Here’s a checklist you can use to figure out if you might be eligible:

- You earned a high school diploma, GED or recognized equivalent

- You have a valid Social Security Number

- You agree any financial aid you get will only be used for your education

- You’re a valid citizen of the US, a permanent US resident with a valid Permanent Resident Card or a US national

- Males have to register with selective service between 18 and 25. If you haven’t already registered, and are still between 18 and 25, you can register right on the FAFSA®!

Filed Your Taxes? They Can Help!

If you filed your taxes you may be eligible to use the IRS Data Retrieval tool to transfer your data directly from the IRS into the FAFSA®. That can save a ton of time and it’ll make sure you don’t mess up inputting any of the info. When completing the financial section of the FAFSA®, you’ll be given an opportunity to answer questions to see if you’re eligible to use this tool.

FAFSA® Award Year

The FAFSA® year isn’t like the calendar year…it goes from the first of July to the end of June the following year. You can start applying as soon as January 1st though, so now is a good time to get started!

We’re Here to Help

The Student Finance Department at Carrington College is here to help every step of the way. We know filling out forms like the FAFSA® can be confusing, and it might be your first time dealing with this stuff. We’ve been doing it for years, so let us help! One last note…apply even if you didn’t get any financial aid last year. Many students think they don’t qualify for financial aid because they weren’t eligible for grants in the previous award year. Grants and loans are both forms of financial aid students use to pay their tuition, and you never know…just because you didn’t qualify last year for grants doesn’t mean you won’t qualify this year! So what are you waiting for? Get cracking on your FAFSA® today!

Sources: https://www.fafsa-application.com/learning-center/who-is-eligible-for-aid https://www.edvisors.com/ask/faq/difference-fafsa-renewal/ [1] Student loans, grants and scholarships are available to those who qualify